This Week

My take on the Equifax breach, as well as restoring individual files from image backups

Busy Fall, broken forms

Things break when I'm on vacation or super busy. Don't know why. Anyway, the "ask a question form" for subscribers was actually broken for a couple of weeks. It should be working now, but remember: you can always hit reply to a newsletter and ask your question that way. :-)

•

What the Equifax Breach Means to You

On September 7th, the U.S. credit reporting company Equifax announced they had suffered a massive data breach some months earlier.

Equifax's handling of that breach has since been termed a “dumpster fire” by noted journalist Brian Krebs. Their instructions, website, and tools to help you determine if you've been impacted have been nothing short of a total mess. The term I'd use instead of dumpster fire isn't appropriate for a family publication.

All indications are that if you've ever had a credit report, your information is likely part of this mess. Even if you're not sure, it's best to assume it.

So. What now?

It's not about passwords

Most of the breaches I discuss are serious because they include account IDs and (hopefully hashed) passwords. The theory is that attackers could use that information to access your existing accounts.

When that's the case, the general advice is to change the passwords on any affected accounts and make sure that you're not using the same password on multiple accounts.

While the latter is always important advice (even when you're not the subject of a breach), changing your passwords won't help in this case.

Passwords weren't involved.

It's about personal information

The stolen information is said to include:

- Names

- Social Security numbers

- Birthdates

- Addresses

- Driver's license numbers

In addition, some people had their credit card numbers and credit report dispute documents (which include personal identifying information) stolen as well.

The hackers apparently have had access to all this information for a couple of months.

Why this is bad, very bad

Two words: identity theft.

Consider just the first four items in the list above: names, Social Security numbers, birthdates, and addresses. That's generally enough to open a credit card account in your name — a credit card account hackers could use and that the credit card company will think is your responsibility.

There are more scenarios beyond just credit cards. Most probably involve getting credit or loans in your name without your consent or knowledge. You are then faced with having to contest those charges, and may have trouble using your credit legitimately, since the hackers will have tarnished your good reputation in the eyes of banks and creditors.

What you can do next

The single most important thing you can do is simply pay attention. Pay attention to your bills, credit cards, paper junk mail, and to what looks like spam that lands in your inbox.

Watch all your monthly bills for unexpected charges. This isn't limited to credit cards, but any charge for which you are notified via paper or electronic mail. If they're not legitimate, contact the company immediately.

Monitor your credit cards closely. In my opinion, simply reviewing the paper statement once a month isn't enough. I enable online access and check more frequently — every few days or at least once a week. In addition, I use credit card services that notify me by text or email each time a charge over a certain amount is made. If I can, I set it to any charge over $1, so I know exactly what's happening. If you see something suspicious, contact the credit card company immediately.

Open the junk mail in your physical mailbox. Often the first notification that something is amiss is a statement or welcome letter from an account you've never heard of. You've never heard of it because you didn't open it — the identity thief did. If it looks like someone opened an account in your name you did not authorize, contact the company immediately.

Watch the spam that lands in your inbox (#1). What you think is spam, because it's about a company or an account you don't have, could potentially be “legitimate” in that it's actually from the company mentioned, and you do have an account with them … an account opened by an identity thief. If you suspect that's the case then contact the company immediately.

Watch the spam that lands in your inbox (#2). Phishing attempts are likely to be on the rise. Using the stolen information, hackers craft even more convincing (yet fake) emails trying to get you to fall for their schemes. Pay extra close attention to all email that leads you to log into your bank, credit card company, or any other website that deals with your personal information. Never click on the link to those sites in email, but instead go to those sites using your own links and bookmarks.

If you find you are the victim of identity theft, even for just a single account, it's important to contact law enforcement as well. Many of the remedies and mitigations rely on police or other formal report being filed.

What you might consider

Part of the mess that is Equifax's handling of this situation revolves around a tool on their website set up to help people determine whether or not they are impacted by the breach. As I write this, it's poorly constructed and exceptionally uninformative. I honestly can't recommend using it just yet.

The traditional response to identity theft is to set up a credit lock or credit monitor on your credit reports. It's a hassle you have to do yourself with each of the three major credit reporting companies: Equifax, TransUnion, and Experian. There are two problems:

- How can we trust Equifax to get it right, in light of this massive breach?

- Depending on where you live, it may or may not be free. In my state (Washington), I'm required to actually be a victim of identity theft, with a corresponding police report to prove it.

I have to admit I'm seriously considering it anyway. I'm also paying attention to any activity on any of the free credit reporting sites, such as Credit Karma. (Important: there are many misleading “free credit report” sites out there. The official site to get your free annual credit reports, as confirmed by the FTC, is annualcreditreport.com.)

An alternative is a more restrictive credit freeze, which is something embraced by Brian Krebs, and something I'm now also considering.

Stay Alert

As I said above, it's important to pay attention to what's happening to your money and your credit. With random threats, breaches, and hacks happening periodically, that's good advice even without the Equifax mess.

More details about the Equifax breach will no doubt come to light in the coming days, hopefully along with more concrete ways to determine if you're impacted. Keep your eyes on the news and other information sources to keep up-to-date.

Updates

2017-09-14: I did end up freezing my credit with Equifax and Experian, and signing up for the free tier of TransUnion's “TrueIdentity”, which also allows you to “lock” access to your credit profile. The process was not painful, and all accomplished online. Equifax was free, having removed the fee for a credit lock until the end of the month at least, and I paid Experian $11 (the fee is based on what state you live in). If you freeze your credit: DO NOT LOSE THE PIN you're assigned. Seriously, I can't overstate the importance of having that PIN should you need to unlock your credit for any reason.

2017-09-14 #2: I also just received my first spam mentioning the Equifax breach specifically. It's likely a phishing attempt in the guise of a free credit report offer. Never respond to or act on unsolicited requests like that. They are almost certainly bogus. Instead, go to known resources — such as those I've listed above — yourself.

Related Links & Comments: What the Equifax Breach Means to You

https://askleo.com/30064

•

The Ask Leo! Guide to Online Privacy

|

There's no avoiding the issue: privacy issues are scary, complex, and even somewhat mystifying. The Ask Leo! Guide to Online Privacy tackles these topics in terms you can understand. The Ask Leo! Guide to Online Privacy will help you understand what's at risk, what steps to take, and what to do when you're not sure. |

|

•

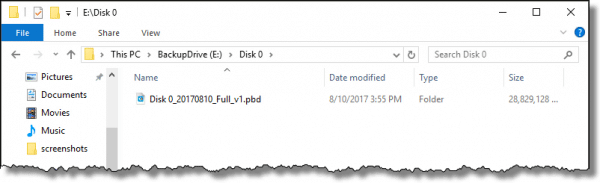

Restoring a File from an EaseUS Todo Image Backup

In a prior article, we created an image backup of your PC using the free version of EaseUS Todo.

Image backups are one of the most important types of backups, because they backup absolutely everything. Should you need to replace a failed hard drive, for example, an image backup will restore everything and let you continue as if nothing had happened.

But what if you don't want everything? What if you just need a single file you know is somewhere in that image backup?

No problem.

Continue Reading: Restoring a File from an EaseUS Todo Image Backup

https://askleo.com/29849

•

The Ask Leo! Tip of the Day

A feature exclusively available to Ask Leo! Patrons Bronze level & above.

- Tip of the Day: Sign Up for Credit Card Usage Alerts

- Tip of the Day: Edit the Subject of a Reply in Gmail

- Tip of the Day: Remove Distractions and Play Windows 10 Games Ad-Free

- Tip of the Day: Spring for that Second Monitor

- Tip of the Day: Try a Different Connection

- Tip of the Day: Navigate Facebook with Your Keyboard

- Tip of the Day: Use Different Words to Search

•

More Ask Leo!

Become a Patron

Books -

Business -

Glossary

Facebook -

YouTube -

More..

•

Leo's Other Projects....

HeroicStories Since 1999, HeroicStories brings diverse, international voices to the world ' reminding us that people are good, that individuals and individual action matter. Stories - new and old - are published twice a week.Not All News Is Bad - Each day I look for one story in the current news of the day with a positive bent. Just one. And I share it.

leo.notenboom.org - My personal blog. Part writing exercise, part ranting platform, it's where I write about anything and everything and nothing at all.

•

Help Ask Leo! Just forward this message, in its entirety (but without your unsubscribe link below) to your friends. Or, just point them at https://newsletter.askleo.com for their own FREE subscription!

Newsletter contents Copyright © 2017,

Leo A. Notenboom & Puget Sound Software, LLC.

Ask Leo! is a registered trademark ® of Puget Sound Software,

LLC